The 2025 Digital Payments Shift: Why a Payment Gateways Comparison Matters More Than Ever

The way money moves online is changing at a pace we’ve never seen before. In 2025, digital transactions are faster, smarter, and more deeply connected to the global economy. Businesses—especially those operating in or serving Pakistan—are now competing in a market where every millisecond, every checkout friction, and every failed payment can mean a lost customer. That’s exactly why a payment gateways comparison isn’t just helpful; it’s essential.

The Acceleration of Digital Payments in 2025

We’re living through a transformative wave where online commerce is shifting from “optional” to “default.” Chip-based cards, mobile wallets, instant bank transfers, biometric approvals, and AI-driven fraud checks have turned payments into a complex but dynamic ecosystem.

A recent report from McKinsey highlighted that global digital payments adoption grew at double-digit rates for the third consecutive year, driven by mobile-first users and rising cross-border trade. This surge directly impacts markets like Pakistan, where ecommerce continues to grow despite infrastructure challenges.

As customer expectations rise, businesses need more than a basic checkout—they need a gateway that offers reliability, intelligence, and flexibility.

Why a Payment Gateways Comparison Is Critical in 2025

Not all payment systems are built the same. While every provider promises speed and security, the real-world experience varies dramatically. A payment gateways comparison helps businesses evaluate what truly matters:

fee structures, fraud protection, API maturity, settlement timelines, Pakistan availability, and support for global card networks.

For local merchants and growing ecommerce brands, choosing the right payment partner can mean higher conversion rates, lower chargebacks, and smoother international expansion. This decision becomes even more crucial when your customers expect secure online payments Pakistan without unnecessary steps or failed transactions.

Pakistan’s Evolving Ecommerce and Its Impact on Payment Choices

Pakistan’s ecommerce sector has shifted from early experimentation to mainstream adoption. With millions of daily digital transactions, the country now demands stronger financial infrastructure and internationally compliant gateways.

As businesses evaluate the best payment gateways in Pakistan, they’re no longer just searching for a way to accept cards—they’re searching for a gateway that supports:

-

Seamless cross-border payments

-

Fraud prevention tuned to South Asian risks

-

Flexible integration options for web and mobile apps

-

Multi-currency support and fast settlements

-

Compliance with banking and fintech regulations

This is where a thorough payment gateways comparison becomes a strategic advantage, helping companies avoid costly mistakes and long-term lock-ins.

The New Reality: Customers Expect Unified, Effortless Payments

Modern customers expect a payment flow that feels invisible. They want to shop, checkout, and complete a transaction without interruptions. Whether they’re buying locally or internationally, the demand for online payment solutions Pakistan continues to rise. Businesses offering smooth payments instantly gain more trust, especially when dealing with high-value items, subscriptions, or repeat purchases.

This rise in expectations pushes businesses to explore fintech payment solutions Pakistan that offer:

-

Tokenised card storage

-

Real-time transaction analytics

-

AI-based risk scoring

-

One-click or one-tap checkout options

-

Subscription management

-

International acceptance for Visa, Mastercard, and Apple Pay

A provider that misses any of these risks losing customers before the transaction is complete.

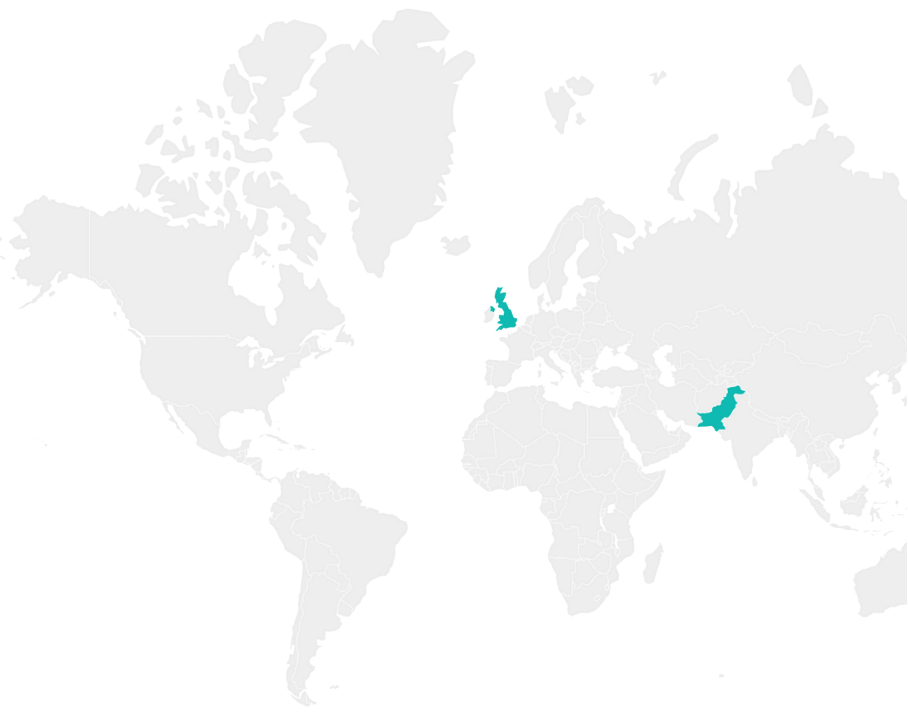

The Role of EmporionSoft in This Fast-Moving Landscape

For businesses navigating this space, understanding the right gateway begins with understanding the right technology partner. EmporionSoft’s global experience in digital engineering and payments integration offers clarity for companies making long-term decisions.

Internal resources such as the Services page and the About page help businesses understand how professional development, API integration, and secure architecture come together to build reliable checkout systems. For deeper discussions or technical consultations, companies often start with the Contact page to explore what fits their model.

By establishing a contextual foundation, this section sets the stage for a deeper dive into each major provider—Stripe, PayPal, Adyen, and Checkout.com—and how they compare for 2025.

The Global Standard in Modern Payment Infrastructure

Stripe’s influence on digital payments is hard to overstate. What began as a developer-friendly checkout tool has expanded into one of the world’s most sophisticated financial technology platforms. In any serious payment gateways comparison for 2025, Stripe consistently appears at the top—not just because of its elegant tools, but because it shapes how modern payments are built.

Why Stripe Dominates the Global Payment Landscape

Stripe is often described as the “operating system for online commerce,” and the phrase fits. It powers millions of businesses across more than 40 countries, from small online shops to global unicorns. Its strength comes from combining simple user experiences with enterprise-grade financial capabilities.

A 2024 analysis by Forbes highlighted Stripe’s role in enabling frictionless global payments and supporting one of the highest authorisation rates in the industry. This reliability is exactly why organisations include Stripe in every major payment gateways comparison for 2025.

Key Features That Set Stripe Apart

Stripe’s feature set goes far beyond basic checkout forms.

Advanced Fraud Protection and Risk Engines

With Stripe Radar, businesses benefit from machine-learning-driven fraud detection trained on billions of data points. This level of intelligence is hard to replicate and is particularly helpful for companies struggling with credit card processing Pakistan where fraud risks can be higher due to regional banking complexities.

Global Payment Method Support

Stripe offers more than 135+ currencies and dozens of payment methods including Visa, Mastercard, Apple Pay, Google Pay, and regional wallets. For international businesses or Pakistani merchants serving global customers, this makes Stripe uniquely compelling.

Subscription and SaaS Billing Tools

Its recurring billing suite is one of the most advanced in the market. Dunning logic, tax automation, metered billing, and flexible subscription rules all work out-of-the-box.

Stripe’s API: The Benchmark for Developers Worldwide

Stripe’s biggest differentiator has always been its API. In fact, many developers still refer to it as the cleanest and most intuitive payment gateway API Pakistan users can integrate with—provided their business structure allows it.

Its documentation (as verified by Stripe Docs) is widely considered the gold standard. Clear, consistent, and deeply flexible, it enables precise customisation for both web and mobile apps. Businesses that need advanced flows—marketplaces, platform payments, or automated payouts—often choose Stripe for this reason alone.

Pricing: Transparent and Predictable

Stripe keeps its pricing simple and clear. The standard transaction fee model (usually around 2.9% + 30¢) varies by region but remains predictable and consistent. This makes financial planning easier compared to gateways with hidden compliance or settlement fees.

For Pakistani companies serving international clients, Stripe’s transparent fees simplify cross-border operations—especially if the local business trades through a foreign entity or partner.

Global Coverage With Local Limitations for Pakistan

Stripe’s biggest strength—its global reach—comes with one caveat: it is not officially available for businesses registered in Pakistan. This often surprises founders evaluating gateways as part of a payment gateways comparison, especially given Stripe’s dominance elsewhere.

However, the situation isn’t entirely limiting.

Workarounds and Alternative Approaches for Pakistan

Many Pakistani businesses still use Stripe through:

-

US, UK, UAE, or EU-based company registration

-

Partnerships or SPVs with global entities

-

Freelancer platforms connected to Stripe-powered systems

-

Platforms using Stripe Connect for sub-merchant payments

For companies offering SaaS, digital services, courses, or global ecommerce, these workarounds make Stripe viable despite the local restriction.

In technical terms, once access is available, payment gateway integration Pakistan can be performed smoothly with the help of experienced engineering partners. Firms like EmporionSoft streamline complex payment flows, automate settlements, and build robust integration layers. Businesses exploring this path can review how EmporionSoft handles advanced engineering through pages like Real-Time AI in Production or the broader Services page.

Why Stripe Still Appears in Every 2025 Comparison

Even with Pakistan-specific challenges, Stripe remains unavoidable in any global analysis. Its innovation pace, API quality, and reliability make it a benchmark against which all others are measured. For businesses expecting global expansion—or serving clients beyond local borders—Stripe often becomes the long-term choice once operational barriers are overcome.

PayPal: Global Trust, Strong Protections, and Regional Gaps in 2025

For many people, PayPal is the first name that comes to mind when they think of digital payments. Its brand recognition is unmatched, shaped by two decades of global presence and billions of transactions. In any broad payment gateways comparison, PayPal stands out as the platform consumers recognise instantly—and that recognition alone continues to influence merchant decisions in 2025.

PayPal’s Global Trust Score and Reputation

Trust is PayPal’s strongest currency. Customers feel comfortable paying through PayPal because the brand carries a long-standing reputation for safety and dispute resolution. According to a 2024 Statista survey, PayPal remained one of the most trusted online payment brands worldwide, particularly valued for its secure transaction flow and predictable user experience.

When comparing international payment gateways Pakistan users might rely on, PayPal’s trust score becomes a significant advantage, especially for businesses serving overseas clients.

PayPal’s Buyer Protection: A Powerful Safety Net

One of PayPal’s biggest differentiators is its Buyer Protection programme.How Buyer Protection Enhances Confidence

If a customer receives an item that is significantly different from what was promised—or doesn’t receive it at all—they can raise a dispute and often get a refund. This extra layer of reassurance encourages hesitant buyers to complete purchases, particularly on unfamiliar ecommerce websites.

For Pakistani merchants targeting global markets, this safety net builds credibility. When customers in the US, UK, or EU see PayPal at checkout, they’re more likely to trust a store they’ve never visited before.

Seller Protection and Fraud Controls

PayPal also offers Seller Protection against certain chargebacks and unauthorised payments. While its policies vary by region, the system helps minimise losses due to fraudulent activity—an issue many Pakistani ecommerce payment providers grapple with.

Understanding PayPal’s Fee Structure in 2025

The cost of using PayPal is often a topic of debate. Its fees can be higher than competitors, but they remain transparent and predictable, especially for cross-border payments.

Typical global fees include:

-

Standard transaction fees around 2.9% + fixed fee

-

Additional charges for international transactions

-

Higher fees for currency conversions

-

Marketplace and platform-specific pricing

For businesses comparing payment gateway fees Pakistan, it’s important to note that fees vary depending on whether the company operates locally or as an international entity. Pakistani-registered businesses cannot receive PayPal payments directly, but entities registered abroad—such as in the UAE, UK, or US—can fully utilise PayPal for global trade.

Merchant Tools Designed for Ease and Growth

PayPal provides a suite of merchant-focused tools that help businesses manage payments more efficiently.

Key features include:

-

PayPal Checkout with one-click payments

-

Subscription and recurring billing

-

Invoicing tools

-

Reporting dashboards

-

Fraud detection and risk scoring

-

Integration with platforms like Shopify, WooCommerce, and Magento

The simplicity of its integration makes PayPal attractive for smaller teams and startups. Many case studies show how businesses accelerated their online sales simply by adding PayPal, making it a consistent mention in ecommerce optimisation strategies. Readers can explore similar examples in EmporionSoft’s Case Studies section.

PayPal’s Limitations in Pakistan

Despite its global dominance, PayPal’s biggest drawback for this region is straightforward: it still does not operate natively in Pakistan.

This absence forces Pakistani merchants to explore alternative methods:

Workarounds and Viable Alternatives

-

Registering a business in PayPal-supported countries

-

Using international business bank accounts

-

Leveraging partner platforms (e.g., Payoneer + US entity)

-

Offering PayPal for exports while using local gateways for domestic transactions

Because local integration isn’t available, businesses often rely on Pakistan-based gateways like JazzCash Payments, EasyPaisa Merchant, Keenu, or QisstPay to support domestic ecommerce. These domestic options fill gaps where PayPal’s services cannot reach, positioning themselves among rising Pakistani ecommerce payment providers.

PayPal’s Ongoing Relevance in 2025

Even with regional restrictions, PayPal remains an essential part of any payment gateways comparison in 2025 due to its unmatched trust, mature dispute systems, and global acceptance. For businesses with international ambitions, PayPal is still one of the most reliable and conversion-friendly tools available.

For teams looking to build multi-gateway payment stacks, API integrations, or hybrid domestic–international setups, EmporionSoft’s experience in fintech engineering and complex architectures—outlined in the Services section—helps companies assess the right blend of providers for their markets.

Adyen: The Enterprise Powerhouse Redefining Global Payments

Adyen has rapidly become one of the most respected names in enterprise fintech. Once known primarily among large European retailers, it now powers payments for global giants, high-growth startups, and multi-channel brands across more than 200 countries. In any payment gateways comparison, Adyen earns its place by offering a complete financial operating system rather than a basic checkout tool. Its focus on enterprise reliability, unified commerce, and advanced risk intelligence sets it apart in 2025.

Unified Commerce: Adyen’s Core Advantage

One of Adyen’s defining strengths is its unified commerce model. Instead of managing separate systems for online, in-store, and mobile transactions, Adyen merges them under a single platform.

Seamless Omnichannel Experience

For retailers handling both digital and physical sales, this unification means:

-

One customer profile across all channels

-

Shared payment methods online and offline

-

Consistent fraud controls

-

Unified reporting dashboards

This is particularly valuable for fast-growing brands offering hybrid operations—subscription boxes with store pickup, online orders fulfilled through physical shops, or loyalty systems linked across multiple devices.

For businesses exploring modern digital payment systems Pakistan, Adyen’s omnichannel capabilities offer a blueprint for what high-end payment infrastructure can achieve at scale.

Advanced Risk Management and Fraud Intelligence

Adyen’s risk engine is one of the most sophisticated in the world. Through AI-driven analysis, behavioural modelling, and global network data, it makes high-accuracy decisions on authorisation, fraud scoring, and dispute prevention.

Real-Time Decisioning That Reduces Losses

Instead of relying on static rules, Adyen uses dynamic modelling based on millions of live transactions. This approach improves authorisation rates while lowering false declines—a major issue for businesses dealing with complex regions and cross-border traffic.

For companies managing ecommerce checkout solutions Pakistan, this level of intelligence can significantly reduce payment failures and improve customer truMulti-Currency Support and Global Reach

Adyen’s multi-currency capabilities make it an ideal gateway for international sellers. It supports over 150 currencies and is deeply integrated with card networks, local banks, and alternative payment methods worldwide.

Advantages include:

-

Local acquiring for higher approval rates

-

Support for regional wallets (WeChat Pay, Alipay, MB Way, iDEAL)

-

Smooth settlement flows across multiple countries

-

In-depth reporting tools to manage global operations

For brands serving customers in the Middle East, Europe, and Asia simultaneously, Adyen removes the friction of juggling multiple gateways and settlement partners.

A detailed breakdown of Adyen’s reach and technology stack can be found in official Adyen financial reports, which consistently highlight its global scaling strategy and technology-first approach.

Transparent and Predictable Pricing

One of the challenges with many enterprise payment providers is non-transparent pricing. Adyen stands out by offering a clear, blended rate model that includes:

-

Interchange

-

Scheme fees

-

Adyen’s processing markup

Unlike other providers that hide charges behind complex tiering, Adyen’s structure allows merchants to forecast long-term payment costs with confidence.

This transparency becomes essential when comparing digital payment systems Pakistan or when evaluating multi-gateway setups for international ecommerce operations.

Pakistan Barriers: Why Adyen Isn’t Common Locally

Despite its global dominance, Adyen faces limitations in regions like Pakistan. It is currently not available for companies registered solely in Pakistan, which restricts domestic merchants from using its platform.

Workarounds and Current Adoption

Businesses that do use Adyen in relation to Pakistan often:

-

Operate through UK, EU, US, or UAE entities

-

Run international ecommerce stores targeting global customers

-

Use Adyen for foreign operations while integrating local gateways for Pakistan-based payments

This hybrid approach is becoming increasingly common among export-focused SaaS companies, fashion brands, and international digital retailers.

To explore multi-gateway architecture or hybrid payment stacks, companies often begin by reviewing technology strategy resources such as EmporionSoft’s Future of Cloud Computing or requesting technical guidance via the Consultation Page.

Adyen’s Role in a 2025 Payment Gateways Comparison

Even with regional challenges, Adyen remains a major contender in the global market. Its unified commerce capabilities, advanced risk intelligence, and international reach make it a preferred choice for large enterprises and fast-scaling brands. For businesses aiming to build modern, resilient payment infrastructures, Adyen sets an important benchmark—especially when comparing top global providers in 2025.

Checkout.com: The MENA-Focused Gateway Gaining Global Momentum in 2025

Checkout.com has become one of the most influential payment providers across the Middle East and North Africa (MENA). Its rapid rise is fuelled by its ability to deliver fast settlements, strong compliance, and tailored support for high-growth digital businesses. In any 2025 payment gateways comparison, Checkout.com stands out as the gateway built for regions that require both global capability and regional sensitivity. Nowhere is this more visible than in the Gulf, where ecommerce and fintech adoption continue to expand at record speed.

Checkout.com’s Dominance in the Middle East

Checkout.com established deep roots in the UAE, Saudi Arabia, Qatar, and Bahrain—markets that demand stability, regulatory compliance, and enterprise-level support. Its success in the region comes from understanding how payments behave in emerging digital economies and designing a platform that meets these unique challenges.

A 2024 Deloitte report highlighted Checkout.com as one of the fastest-growing fintechs in MENA, driven by surging online retail, digital wallets, and cross-border transactions. This regional strength is one of the main reasons it consistently appears in a global payment gateways comparison.

Key Features That Make Checkout.com Enterprise-Ready

Checkout.com delivers a sophisticated suite of tools designed for ambitious merchants, global marketplaces, and subscription platforms.

High Authorisation Rates Through Local Acquiring

One of its biggest advantages is local acquiring in markets where global gateways often struggle. This means fewer declines, better reliability, and more successful transactions for regional customers.

Multi-Currency and Global Payment Method Support

Checkout.com supports:

-

Over 150 currencies

-

Major card networks (Visa, Mastercard, AMEX)

-

Apple Pay and Google Pay

-

Popular regional wallets

-

Local Middle Eastern payment instruments

This flexibility is essential for businesses needing both global reach and regional compliance.

Flexible API and Modern Developer Tools

Its payment API is fast, clean, and built with modern engineering standards. This design makes it easier for technical teams to create personalised checkout flows, automated settlement reporting, marketplace split payments, and recurring subscriptions.

For companies exploring secure online payments Pakistan, a modern API and high authorisation rates can dramatically improve customer conversions—especially when dealing with cross-border buyers or global customers.

A Transparent and Flexible Pricing Model

Checkout.com’s pricing structure is based on a straightforward per-transaction fee combined with interchange costs. Unlike providers that hide fees behind complex models, Checkout.com emphasises clarity and predictability.

Its pricing is typically customised for medium to large businesses, making it attractive for:

-

Marketplaces

-

Subscription-based businesses

-

Export-focused ecommerce stores

-

High-volume merchants

This transparency helps companies plan costs more effectively—an important factor when comparing global providers in 2025.

Strong Fraud Prevention and Risk Management Tools

Fraud remains a pressing concern for global merchants, and Checkout.com takes a proactive approach with:

-

Machine-learning-driven risk scoring

-

3D Secure (2.0) optimised flows

-

Behavioural analytics

-

Real-time rule configuration

-

Regional fraud modelling

These tools help reduce chargebacks and false declines. For fast-scaling businesses, the ability to fine-tune risk settings without sacrificing conversions is a critical advantage.

Compatibility With the Pakistani Market

While Checkout.com does not currently support Pakistan-based business registrations, it remains a viable option under certain conditions.

How Pakistani Businesses Can Still Use Checkout.com

Businesses in Pakistan often use Checkout.com through:

-

UAE, UK, Singapore, or EU-registered entities

-

International ecommerce stores selling abroad

-

Cross-border digital services

-

SaaS companies targeting global customers

In these cases, Checkout.com offers a strong alternative to more restrictive global gateways. For companies evaluating local payment processors Pakistan versus global options, Checkout.com fits perfectly when the target market is outside Pakistan.

Pakistani founders exploring hybrid models—local payments for domestic buyers and Checkout.com for international customers—often seek strategic support through EmporionSoft’s Our Insights hub or start a technical discussion via the Contact Page.

Checkout.com’s Position in the 2025 Landscape

With its strong MENA presence, enterprise-grade tools, transparent pricing, and superior authorisation rates, Checkout.com has secured its position as one of the most important providers in any modern payment gateways comparison. Its capabilities fit the needs of businesses that operate across borders, serve the Middle East, or require a reliable partner for complex payment workflows.

The 2025 Side-by-Side Comparison: Understanding What Truly Sets Each Gateway Apart

Choosing the right payment provider has become a mission-critical decision for businesses in 2025. With customer expectations rising and ecommerce competition intensifying, a clear payment gateways comparison helps companies avoid costly mistakes and choose solutions that align with their growth strategy. The differences between providers can seem subtle, but they have an enormous impact on conversion rates, fraud prevention, compliance, and international expansion.

The 2025 Payment Gateway Comparison Table

To make the evaluation easier, here is a concise yet meaningful comparison of Stripe, PayPal, Adyen, and Checkout.com—four of the most-discussed platforms in global and Pakistan-focused payment research.

Feature & Capability Comparison (2025 Snapshot)

| Criteria | Stripe | PayPal | Adyen | Checkout.com |

|---|---|---|---|---|

| API Strength | Industry-leading; highly flexible | Moderate; easy to use | Advanced; enterprise-level | Modern; clean and developer-friendly |

| Global Coverage | 40+ supported countries | 200+ consumer markets | 200+ markets via acquiring | Strongest in MENA + global expansion |

| Payment Methods | Cards, wallets, local methods | PayPal, cards, wallets | Extensive, including regional methods | Cards, wallets, MENA-specific options |

| Fraud Prevention | Stripe Radar (ML-driven) | Buyer/Seller Protection | Network-wide behaviour modelling | Robust fraud engine with 3DS optimisation |

| Pricing Transparency | Clear fees; predictable | Transparent but higher for cross-border | Interchange++ model; very transparent | Custom pricing; enterprise-friendly |

| Pakistan Compatibility | Not available locally; via foreign entities | Not available locally; via foreign entities | Not available for Pakistan entities | Not available locally; UAE/EU/UK entities needed |

| Best For | SaaS, global ecommerce, platforms | Cross-border sellers, small merchants | Enterprise retail, omnichannel brands | High-growth MENA + international merchants |

| Ease of Integration | Excellent | Very easy for basic flows | Moderate (enterprise setups) | Easy; modern API |

| Settlement Speed | Fast | Moderate | Fast (local acquiring) | Very fast in MENA |

This comparison reflects findings from industry analyses and global payment trend reports, including research published by McKinsey & Company in 2024 highlighting the rapid evolution of cross-border digital payments.

Best Fit Analysis: Who Should Choose Which Gateway?

A table alone doesn’t tell the whole story. Each payment provider excels in specific business models, markets, and operational needs.

Stripe: Ideal for SaaS, Marketplaces, and Global Ecommerce

Stripe remains a favourite among developers and global-first businesses because of:

-

Exceptional API flexibility

-

High authorisation rates

-

Strong subscription tools

-

Rich analytics and automation

Businesses targeting the US, UK, EU, or UAE markets often include Stripe at the top of their payment gateway reviews Pakistan lists—even if they need foreign registration to use it.

PayPal: Best for Trust, Simplicity, and Cross-Border Buyers

PayPal wins when:

-

Brand recognition matters

-

Customer trust drives conversions

-

A one-click express checkout improves sales

For companies exporting digital services, creative work, or ecommerce goods, PayPal remains one of the most reliable global paths to receive payments.

Adyen: Built for Enterprise Retail and Unified Commerce

Adyen is the strongest option for:

-

Omnichannel retailers

-

Multi-country operations

-

Large-scale ecommerce

-

Businesses wanting one system for online + in-store

Its unified commerce model and enterprise-grade fraud controls make it a benchmark gateway in many global comparisons.

Checkout.com: Best for MENA-Centric and High-Growth Digital Brands

Checkout.com’s strongest capabilities shine when:

-

Serving UAE, Saudi Arabia, or Qatar

-

Operating in high-volume ecommerce markets

-

Managing complex multi-currency or multi-market setups

-

Requiring MENA compliance and local acquiring

This makes it a rising contender in regions where Pakistan-based founders expand abroad.

Pakistan-Specific Perspective: Which Gateway Works Best for Local Businesses?

While none of these four gateways support Pakistani-registered businesses directly, they still matter significantly in best payment gateways in Pakistan research because many founders operate through:

-

UAE entities

-

UK/US/EU companies

-

Hybrid international ecommerce setups

-

Multi-gateway payment stacks

Locally, businesses often pair these international gateways with domestic processors like JazzCash, EasyPaisa Merchant, Keenu, QisstPay, or bank-backed solutions. The combination allows merchants to offer secure online payments Pakistan users expect while also supporting global customers.

For companies exploring advanced architectures, EmporionSoft’s experience in cloud-native fintech systems and multi-gateway integration is documented across insights and case materials. Businesses can explore the Services page for technical capability details or request guidance directly through the Consultation page.

Understanding the Real Differences in 2025

When viewed side-by-side, the main differentiators become clear:

-

Stripe excels in developer flexibility and global API-driven commerce.

-

PayPal dominates in trust, ease of use, and consumer familiarity.

-

Adyen leads in enterprise scale, unified commerce, and global acquiring.

-

Checkout.com wins in the Middle East and high-growth regional markets.

This structured understanding prepares businesses for the next step: choosing the right gateway based on their size, goals, and market focus.

Choosing the Right Gateway for Your Business: A Practical Guide for Pakistan in 2025

Every business in Pakistan faces different payment challenges, so choosing the right provider shouldn’t feel like guesswork. Whether you’re a startup owner, a growing ecommerce brand, or a service provider working with global clients, the decision must be rooted in practicality—not hype. With so many options and limitations, finding the right fit requires clarity, context, and an understanding of how each gateway performs in the real world.

Start With Your Business Size and Growth Goals

Not every payment provider is suitable for every business. The right match depends on where you are now—and where you want to go.

Small Businesses and Local Sellers

If your primary customers are in Pakistan, you’ll likely depend on online payment solutions Pakistan such as JazzCash, EasyPaisa, Keenu, or bank-led merchant gateways. These tools are affordable, compliant with the State Bank of Pakistan (SBP), and easier to onboard with.

For micro and small retailers, the ideal payment gateway for small businesses Pakistan is one that offers:

-

Low setup fees

-

Simple integration

-

Support for local bank accounts

-

Reliable domestic settlements

-

Easy refunds and dispute processes

These requirements often push smaller merchants toward domestic processors rather than international gateways.

Mid-Sized and Growing Ecommerce Brands

Scaling merchants, especially those selling to the UAE, UK, US, or EU, must think beyond domestic constraints. At this stage, businesses often explore:

-

Stripe (via foreign entity)

-

Checkout.com (via UAE or UK setup)

-

PayPal (via foreign registration)

-

Adyen (for global retail expansion)

This hybrid model—local gateway for Pakistan + international gateway for exports—is becoming the new normal. According to SBP’s 2024 Digital Payments Report, cross-border ecommerce from Pakistan continues to grow, despite regulatory limitations. This growth pushes more businesses to adopt multi-gateway setups.

Consider Your Payment Flow and Customer Experience

The structure of your payments matters more than most founders realise.

One-Time Purchases

If customers typically pay once and leave, then speed, trust, and low friction should be the priority. PayPal and Stripe (via foreign entities) often win here because they reduce the psychological barrier at checkout.

Subscription or Recurring Billing

SaaS platforms, membership communities, and digital product creators need:

-

Automatic recurring billing

-

Card tokenisation

-

Retry/dunning logic

-

Global card support

Stripe and Adyen lead this category thanks to their rich API features, high authorisation rates, and built-in automation tools.

Marketplace or Platform Payments

Businesses needing split payments—like multi-vendor marketplaces, tutoring networks, ride-sharing platforms, or service marketplaces—require advanced orchestration. These features exist primarily in Stripe Connect and Adyen for Platforms.

In these cases, the most practical approach is often a foreign entity so you can legally connect to these advanced tools.

Integration Cost and Technical Complexity

Understanding integration cost can save businesses months of frustration.

Low-Code or No-Code Integration

PayPal and local gateways typically offer fast plug-and-play integration with:

-

Shopify

-

WooCommerce

-

Wix

-

WordPress

-

Local POS systems

These are perfect for merchants who don’t have in-house engineering expertise.

Custom API Integration

Stripe, Adyen, and Checkout.com shine when you need:

-

A fully customised checkout

-

Advanced business logic

-

Multi-step payment flows

-

Compliance automation

-

Scalable global infrastructure

This is where a technical partner becomes essential. EmporionSoft’s expertise in payment engineering, custom integrations, and API orchestration can be explored via the Services page or by initiating a discussion through the Contact Us page.

Addressing Pakistani Compliance & Banking Limitations

Pakistan’s regulatory environment adds practical constraints:

-

International gateways require foreign business registration

-

Compliance checks delay onboarding

-

Local banks impose rules on dollar settlements

-

SBP approval is required for some cross-border flows

Because of these limitations, Pakistan-based companies often use combinations such as:

-

JazzCash/EasyPaisa + Stripe (foreign)

-

Bank payment gateway + PayPal (foreign)

-

Local processor + Checkout.com (UAE entity)

This strategy aligns with SBP guidelines while enabling international payments.

Cross-Border Settlements: An Important Differentiator

If international clients are your primary market—IT services, SaaS, consultancy, or ecommerce exports—you must prioritise:

-

Settlement timelines

-

FX conversion fees

-

Country-specific compliance

-

Chargeback protection

-

Global card acceptance

Stripe and PayPal dominate cross-border acceptance, while Checkout.com offers exceptional performance for MENA-focused exporters.

Helping Pakistani Businesses Make the Right Choice

Selecting the right payment gateway isn’t about choosing the most famous provider; it’s about choosing the one that aligns with your market, compliance needs, and long-term ambitions. With the right combination of local and global tools, businesses in Pakistan can create a frictionless payment experience that supports both domestic buyers and global clients.

Final Thoughts: Choosing the Right Payment Gateway for 2025 and Beyond

If there’s one insight that stands out from this entire payment gateways comparison, it’s that no single provider fits every business. Stripe leads in developer flexibility and international reach. PayPal remains the global trust champion. Adyen offers unmatched enterprise-scale unified commerce. Checkout.com dominates the MENA region with impressive authorisation rates and regional optimisation. Each platform has its strengths—and each aligns with different business models, customer bases, and geographic priorities.

What This Comparison Reveals About 2025

The payments ecosystem in 2025 is faster, more intelligent, and more interconnected than ever. Gateways no longer simply “process cards”; they provide:

-

Fraud intelligence

-

Subscription billing

-

Behavioural modelling

-

Multi-currency orchestration

-

Cross-border compliance

-

API-first infrastructure

This evolution makes it essential for businesses—especially those in or serving Pakistan—to choose the right combination of domestic and international providers. With rising ecommerce adoption, subscription models, and mobile-first buyers, the demand for secure online payments Pakistan consumers can trust is only increasing.

A recent analysis by Visa emphasised that digital payment maturity across developing markets is accelerating far beyond earlier predictions, driven by mobile wallets, cross-border ecommerce, and customer expectations for instant, friction-free checkout flows. These trends are shaping how Pakistani businesses plan their next step.

Reassessing Pakistan’s Unique Fintech Environment

Pakistan’s financial ecosystem presents both challenges and promising opportunities. Local infrastructure supports strong domestic transactions, but international acceptance remains limited, forcing businesses to think creatively—especially those targeting overseas clients.

Key realities shaping decisions include:

-

International gateways require foreign entities

-

SBP compliance for cross-border flows

-

Limited availability of global payment brands

-

Local processors improving but still maturing

-

Rising demand for online payment solutions Pakistan across all sectors

-

Growing support for hybrid stacks (local + international)

In this environment, the best payment gateways in Pakistan are often not a single provider but a carefully planned combination: one domestic solution for local buyers and one international gateway for global expansion.

Matching Gateways to Business Models

From small retailers to global-scale SaaS platforms, businesses must choose based on practicality:

-

Small businesses benefit from easy local onboarding and predictable fees.

-

Growing ecommerce brands need tools that handle recurring billing and multi-currency support.

-

Export-focused companies rely on gateways with strong cross-border acceptance.

-

Startups building marketplaces or apps require advanced payment gateway API Pakistan workflows that global players like Stripe and Adyen specialise in.

This is where technical expertise makes a difference—not just choosing a gateway, but designing the payment architecture around it.

Why Technical Leadership Matters in 2025

Payments are no longer a plug-and-play feature. Modern gateways require:

-

Secure integration

-

API orchestration

-

Reconciliation and reporting

-

Subscription and marketplace logic

-

Fraud prevention configuration

-

Compliance alignment

EmporionSoft helps businesses navigate these complexities with world-class engineering, cloud-native architecture, and global-scale fintech expertise. Founders, product teams, and enterprise leaders exploring payment integration or checkout modernisation can learn more about these capabilities through the EmporionSoft Services page or begin planning with the team directly via the Contact Page.

A Confident Path Forward With EmporionSoft

If your business wants to offer frictionless payments, expand globally, or modernise your ecommerce platform, the right technical partner is essential. EmporionSoft Pvt Ltd has delivered advanced solutions for brands across the UK, Middle East, EU, and South Asia—helping them implement:

-

Payment gateway integration

-

Custom ecommerce development

-

API integration and orchestration

-

Fintech engineering and secure payment workflows

Your customers deserve a fast, seamless, and secure payment experience. With EmporionSoft’s expertise, you can build systems that not only meet today’s standards but prepare you for tomorrow’s growth.

Ready to create a payment system built for 2025 and beyond? EmporionSoft is here to build it with you