Understanding Technical Debt Beyond Code Quality

Technical debt is often framed as a code quality issue. In practice, its impact is financial. The true technical debt financial impact appears in slower delivery cycles, rising maintenance costs, and reduced strategic flexibility. For founders and CTOs, this is not an engineering concern alone. It is a balance sheet variable.

At its core, technical debt represents deferred work. Teams make short term trade offs to ship faster, meet investor expectations, or respond to market pressure. Over time, these decisions accumulate. What begins as a pragmatic compromise becomes structural inefficiency. The financial consequences compound quietly.

The concept is explained in more detail in our analysis of technical debt explained: how to identify, manage and eliminate it. However, understanding it through a financial lens requires reframing the conversation. Debt increases the cost of change. When every feature takes longer to implement, labour costs rise. When testing cycles expand, operational overhead grows. When architecture lacks resilience, infrastructure costs escalate.

For startups, the hidden costs of technical debt are particularly severe. Early stage companies often prioritise product market fit over structural soundness. This is reasonable. The risk emerges when temporary shortcuts become permanent patterns. Investors conducting due diligence frequently evaluate architecture maturity because it directly affects scalability and exit readiness. Independent technical reviews, such as those described by TheCodeV’s technical due diligence framework, treat accumulated debt as a valuation risk factor.

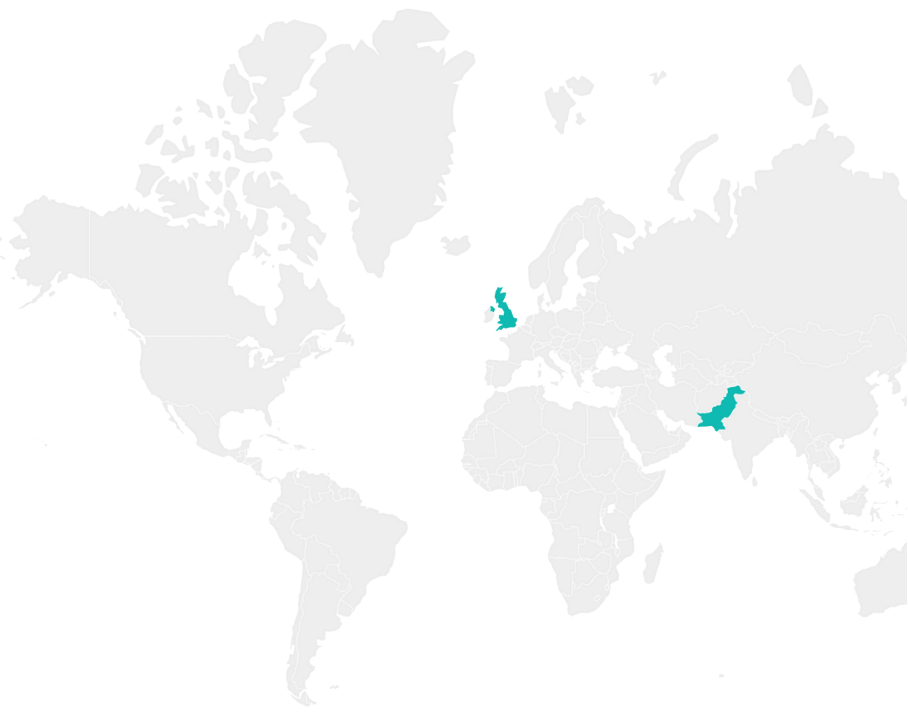

SMEs face a different version of the same problem. Legacy systems that evolved without architectural oversight create friction in daily operations. Integration becomes expensive. Reporting becomes unreliable. Decision making slows. In markets where margins are tight, even modest increases in software maintenance cost can erode profitability. This is especially relevant in cost sensitive regions where structured software maintenance cost models, including in Pakistan, influence long term technology planning.

It is also important to distinguish between cosmetic issues and structural debt. Not every code smell has material financial consequences. The real cost arises when system design limits adaptability. When onboarding a new client requires manual intervention. When regulatory changes demand extensive rework. When infrastructure cannot scale without full redesign.

This is where technical debt overlaps with scalability debt. While related, they are not identical. Scalability debt emerges when architecture cannot support growth without disproportionate cost increases. Technical debt may not always block growth immediately, but it reduces the efficiency of growth. The financial distinction matters.

From a strategic standpoint, organisations that treat engineering as a capital investment rather than a cost centre tend to manage debt more effectively. Aligning development decisions with measurable return metrics, as outlined in our discussion on technology ROI metrics, creates transparency. When leadership understands how architecture influences long term cost structure, trade offs become deliberate rather than reactive.

Ultimately, technical debt is not a moral failure of engineering discipline. It is a byproduct of decision making under constraint. The financial impact depends on governance. Teams that document trade offs, measure debt ratio, and schedule refactoring cycles maintain control. Teams that ignore accumulation allow hidden liabilities to shape future budgets.

For founders and product leaders, the key shift is perspective. Technical debt financial impact is not abstract. It influences valuation, operating margin, customer retention, and growth velocity. Code quality is simply the visible surface of a deeper economic dynamic.

The Financial Mechanics of Technical Debt Accumulation

Technical debt rarely appears as a single large expense. It builds incrementally. A delayed refactor in one sprint. A temporary workaround that becomes permanent. A release pushed without adequate testing. Each decision seems rational in isolation. Collectively, they alter the cost structure of the product.

The technical debt financial impact becomes visible when engineering velocity begins to decline. Features that once required two weeks now take four. Bug cycles increase. Regression testing expands. Product managers adjust roadmaps not because of strategy shifts, but because implementation complexity rises. The financial effect is subtle at first, then structural.

In Agile environments, debt accumulation often hides behind delivery metrics. Sprint burndown charts can look healthy while architectural integrity weakens. When teams focus exclusively on feature throughput without allocating capacity for remediation, debt ratio increases. Over time, the backlog becomes dominated by technical fixes rather than market facing improvements.

This pattern is explored further in our guide on DevSecOps for small teams, where disciplined integration and testing practices are positioned as cost controls, not just security measures. Weak CI pipelines and inconsistent code reviews increase rework. Rework consumes budget without generating new revenue.

Financially, the compounding mechanism resembles interest accrual. Every future change interacts with imperfect structure. Engineers spend more time understanding legacy decisions. Onboarding new developers takes longer because knowledge is undocumented or fragmented. Knowledge concentration increases key person risk, which itself has financial implications.

The opportunity cost is equally important. When engineering time is consumed by maintenance, strategic initiatives are delayed. A startup may postpone a new integration. An SME may defer digital transformation. In both cases, lost opportunity has a measurable value. The cost is not just what is spent, but what cannot be pursued.

Quality assurance discipline plays a decisive role. Insufficient testing during early releases shifts cost to later stages. Our beta testing guide outlines how structured pre release validation reduces downstream maintenance overhead. Without these controls, post release fixes become routine. Each patch introduces additional complexity.

Another dimension is infrastructure inefficiency. Poorly structured systems consume excessive cloud resources. Redundant services remain active. Scaling decisions are reactive rather than planned. These inefficiencies increase operating expenditure month by month. While individual cloud invoices may not appear alarming, cumulative annual spend reveals the impact.

From a financial modelling perspective, debt affects both direct and indirect costs. Direct costs include additional developer hours and increased infrastructure usage. Indirect costs include slower time to market, reduced innovation capacity, and investor perception risk. When leadership teams evaluate technology return on investment using frameworks such as those discussed in technology ROI metrics, debt appears as a drag coefficient on performance.

The critical issue is governance. Reducing technical debt ratio in Agile environments requires explicit allocation of sprint capacity. Many high performing teams dedicate a fixed percentage of development time to refactoring and optimisation. This approach stabilises long term cost curves. Without it, maintenance effort grows unpredictably.

Technical debt accumulation is not accidental. It is the outcome of prioritisation decisions under pressure. The financial mechanics are predictable. If debt grows faster than remediation capacity, the system becomes increasingly expensive to maintain and increasingly resistant to change. Over time, the cost of inaction exceeds the cost of structured intervention.

Hidden Costs of Technical Debt in Startups and SMEs

The most damaging aspect of technical debt is not always visible in development metrics. The deeper technical debt financial impact appears in areas that founders and SME owners often discover too late. These include investor perception, regulatory exposure, operational inefficiency, and team productivity loss.

For startups, valuation sensitivity is particularly acute. During funding rounds or acquisition discussions, technical due diligence assesses architecture resilience, documentation quality, security posture, and scalability readiness. Accumulated shortcuts signal future cost risk. Investors interpret high remediation effort as reduced capital efficiency. This can directly affect valuation multiples.

Security exposure is another hidden cost. Inadequate refactoring, outdated dependencies, and weak access controls increase vulnerability surfaces. Compliance frameworks such as PCI DSS or data protection regulations demand structured architecture. Our analysis of data privacy frameworks for SMEs outlines how governance gaps create regulatory and reputational risk. Technical debt increases the probability of non compliance, and remediation under regulatory pressure is significantly more expensive than proactive improvement.

SMEs face operational consequences that are less visible but equally material. Many organisations operate on systems that evolved over years without cohesive architecture planning. Integrations between accounting tools, CRM platforms, and inventory systems become fragile. Reporting accuracy declines. Manual interventions increase. These inefficiencies affect cash flow forecasting and strategic planning.

Custom ERP implementation projects often reveal legacy debt embedded in core workflows. When businesses in Pakistan pursue custom ERP implementation services, they frequently discover undocumented dependencies and redundant processes. Modernisation becomes more complex because underlying systems were never structured for extensibility.

Hiring and retention also suffer. Skilled engineers prefer working with maintainable codebases and modern toolchains. When technical debt is high, onboarding requires extended ramp up time. New hires must navigate inconsistent patterns and legacy conventions. Productivity declines during transition periods. Recruitment costs increase because retention rates fall.

Product delivery risk compounds this problem. Mobile app teams working on Flutter or native stacks may initially deliver quickly. Over time, absence of structured QA and architectural oversight increases defect density. External support from structured software QA services in Karachi or equivalent disciplined practices becomes necessary to stabilise release cycles. This introduces additional cost that could have been avoided with early governance.

Another underestimated dimension is strategic inflexibility. When systems lack modularity, pivoting becomes expensive. A fintech startup exploring secure payment gateway integration may discover that its original architecture cannot support required encryption standards without significant rewrite. Each pivot becomes a partial rebuild rather than an incremental extension.

SMEs operating in competitive markets face similar constraints. Legacy architecture slows digital expansion into e commerce, automation, or AI driven workflows. Leadership teams hesitate to adopt new capabilities because integration risk appears high. The opportunity cost of inaction grows, even if it does not appear on financial statements.

Case evidence from structured delivery environments, such as those presented in EmporionSoft case studies, shows that organisations addressing technical debt early maintain greater operational resilience. They absorb growth without proportionate cost escalation.

Ultimately, hidden costs accumulate in trust erosion. Investors question sustainability. Customers experience instability. Employees feel friction in daily workflows. None of these effects appear immediately in sprint reports, yet they shape long term business outcomes. Technical debt is not confined to code repositories. It influences valuation, compliance, talent retention, and strategic agility.

Scalability Debt vs Technical Debt: Strategic Growth Constraints

Technical debt and scalability debt are related but distinct. Both influence the technical debt financial impact, yet they operate at different layers of business risk. Understanding the difference allows leadership teams to prioritise intervention correctly.

Technical debt refers to compromises in code quality, structure, or documentation that increase maintenance effort. Scalability debt emerges when architecture cannot support growth without disproportionate increases in cost or complexity. An application may function reliably for 1,000 users but fail economically at 100,000. In such cases, the constraint is structural rather than cosmetic.

Early stage products often begin as monolithic systems. This is rational. Monoliths accelerate initial delivery and reduce coordination overhead. However, as feature sets expand and user demand grows, tightly coupled systems limit flexibility. Scaling requires vertical infrastructure expansion rather than horizontal distribution. Infrastructure costs rise sharply, and deployment cycles slow.

The long term trade offs between architectural styles are analysed in microservices vs serverless. When organisations delay architectural evolution beyond the point of operational strain, scalability debt accumulates. The cost of migration later is significantly higher than incremental evolution.

API design also plays a central role. Poorly structured APIs create integration friction. External partners require custom workarounds. Internal teams duplicate logic. Over time, these inefficiencies multiply. Our discussion on building scalable APIs for SaaS platforms outlines how design discipline reduces future expansion cost. Without it, growth becomes operationally expensive.

Cloud strategy amplifies these risks. Systems built without elasticity planning consume excessive compute during traffic peaks and remain underutilised during low demand periods. Hybrid deployment models can mitigate this, but only if designed intentionally. The principles behind this approach are examined in hybrid cloud strategies for SMEs. Scalability debt often reveals itself through unpredictable cloud invoices and performance instability under load.

From a financial perspective, scalability debt distorts unit economics. Customer acquisition may remain efficient, yet infrastructure cost per user increases faster than revenue per user. This compresses margins and complicates fundraising narratives. Investors examine whether growth improves operating leverage or degrades it.

Technical debt contributes indirectly to scalability debt. When codebases lack modularity, extracting services becomes complex. Data models that evolved without normalisation resist horizontal scaling. Migration from monolithic to distributed systems demands significant re engineering. What could have been phased architectural improvement becomes a capital intensive transformation project.

Architectural patterns influence this trajectory. Structured layering, service boundaries, and domain driven design reduce the risk of scalability bottlenecks. Our overview of enterprise architecture patterns highlights how deliberate system design supports predictable expansion. Organisations that neglect these foundations eventually encounter structural ceilings.

It is important not to over engineer prematurely. Not every startup requires microservices from day one. The key is governance. Leadership must regularly evaluate whether architecture aligns with projected growth curves. If revenue strategy anticipates rapid scaling, infrastructure and system design must support that ambition.

Scalability debt is ultimately a growth tax. It does not prevent initial success, but it restricts sustained expansion. When ignored, it transforms opportunity into operational strain. Recognising its distinction from general technical debt allows organisations to allocate capital and engineering effort more precisely, preserving both performance and margin as scale increases.

Measuring and Reducing Technical Debt Ratio in Agile Environments

Managing the technical debt financial impact requires quantification. Without measurable indicators, remediation becomes reactive and inconsistent. In Agile environments, the objective is not to eliminate debt entirely. The objective is to maintain a controlled debt ratio that aligns with business goals.

Technical debt ratio can be defined as the proportion of remediation effort relative to overall development capacity. When more sprint capacity is allocated to fixing defects, refactoring legacy code, or resolving integration instability, the ratio increases. If this trend continues unchecked, feature velocity declines and cost per feature rises.

Agile governance frameworks should therefore include debt visibility in backlog management. Teams benefit from tagging tasks explicitly as debt remediation. This prevents technical work from being hidden under feature tickets. Transparent categorisation supports financial clarity. Leadership can evaluate whether debt accumulation is accelerating beyond acceptable thresholds.

Structured evaluation builds on foundational concepts discussed in technical debt explained: how to identify, manage and eliminate it. However, the practical challenge is implementation discipline. Many organisations recognise the problem yet fail to schedule consistent remediation cycles.

A common approach is fixed allocation. High performing teams often dedicate 15 to 25 percent of sprint capacity to refactoring, performance optimisation, and dependency upgrades. This stabilises long term maintenance curves. It also prevents emergency remediation projects that disrupt roadmap planning.

Automation strengthens this process. Static code analysis tools, continuous integration checks, and automated testing pipelines reduce defect introduction. Increasingly, AI assisted tools are used for repetitive optimisation. Structured governance models such as those outlined in AI governance for SMEs help organisations adopt automation responsibly while maintaining oversight.

Automated code refactoring capabilities, including support for Android and cross platform environments, can accelerate technical clean up cycles. However, these tools must operate within defined quality standards. Automation reduces labour cost only when review processes remain rigorous.

Another metric to monitor is change failure rate. If deployment frequency decreases while incident frequency increases, debt may be constraining agility. Combining these operational indicators with financial metrics such as cost per release creates a clearer picture of long term impact.

Leadership alignment is essential. Product owners must recognise that not all sprint capacity should be devoted to visible features. Engineering health influences future revenue potential. Aligning technical priorities with strategic planning prevents short term delivery pressure from overwhelming long term resilience.

Organisations exploring structured automation strategies often begin with roadmap exercises similar to those described in AI roadmap for small business. These frameworks align innovation initiatives with governance structures. The same discipline applies to debt management.

Reducing technical debt ratio in Agile environments is not about slowing delivery. It is about protecting delivery sustainability. When debt is measured, prioritised, and addressed incrementally, financial impact remains predictable. When ignored, it compounds silently.

The outcome of disciplined debt governance is stability. Teams maintain velocity. Infrastructure costs remain proportional to growth. Investor confidence improves because risk exposure is transparent. Measuring and reducing debt ratio transforms technical debt from an uncontrolled liability into a managed operational variable.

Technical Debt, Cloud Economics, and FinOps Discipline

Cloud infrastructure has changed how organisations perceive technology cost. Capital expenditure has shifted toward operating expenditure. Billing is dynamic, usage based, and often decentralised. In this environment, the technical debt financial impact becomes closely tied to cloud economics.

Poor architectural decisions directly influence cloud spend. Redundant services, inefficient database queries, excessive logging, and over provisioned instances increase monthly invoices. These inefficiencies may remain unnoticed in early stages when user volumes are low. As traffic grows, cost anomalies surface.

Technical debt often manifests as infrastructure sprawl. Teams provision resources quickly to meet deadlines but fail to consolidate them later. Unused storage, duplicated environments, and unoptimised containers accumulate. Over time, these small inefficiencies become persistent operating overhead.

Our analysis on cloud cost optimization strategies explains how observability and structured review cycles reduce unnecessary expenditure. However, cost optimisation cannot compensate for weak architecture. When systems are not designed for elasticity, scaling requires manual intervention or disproportionate resource allocation.

FinOps introduces financial accountability into cloud operations. It aligns engineering, finance, and leadership around usage transparency. Instead of viewing infrastructure cost as a technical detail, FinOps treats it as a controllable business metric. This approach is particularly relevant when managing long term technical debt.

Technical debt increases cloud inefficiency in several ways. Legacy services may remain active because decommissioning them risks system instability. Data models that evolved without optimisation generate excessive read and write operations. Lack of monitoring makes it difficult to detect cost spikes early.

Hybrid deployment models can mitigate some risks by balancing on premise and cloud workloads. The principles behind structured deployment planning are examined in hybrid cloud strategies for SMEs. However, hybrid approaches require disciplined governance. Without it, complexity increases rather than decreases.

Another dimension is forecasting. When architecture lacks modularity, predicting resource needs becomes difficult. Budgeting for infrastructure then relies on reactive scaling rather than strategic modelling. Finance teams lose visibility, and cost variance widens. This unpredictability complicates investment planning.

Future cloud innovation trends emphasise automation, AI assisted optimisation, and serverless architectures. These developments are explored in the future of cloud computing. While they promise efficiency gains, they do not eliminate the need for disciplined system design. Automated scaling cannot compensate for inefficient data access patterns or fragmented service boundaries.

For startups and SMEs, cloud cost misalignment can distort unit economics. If infrastructure cost per customer increases faster than revenue per customer, growth becomes unsustainable. Technical debt magnifies this risk because remediation requires additional engineering effort on top of existing inefficiencies.

FinOps for cloud cost optimization therefore intersects directly with debt management. Regular cost reviews, tagging discipline, performance profiling, and architectural audits form part of a unified governance model. When engineering teams treat infrastructure design as a financial responsibility rather than a purely technical concern, cost curves stabilise.

Ultimately, cloud spending is not inherently unpredictable. Variability emerges from unmanaged complexity. Technical debt amplifies complexity. By integrating FinOps discipline with structured refactoring cycles, organisations maintain control over operating expenditure and preserve margin as they scale.

Modernisation, Refactoring, and Migration: Evaluating ROI

Addressing accumulated technical debt requires capital allocation. Leadership teams must evaluate whether incremental refactoring, partial modernisation, or full migration delivers the strongest return. The discussion is not purely technical. It centres on measurable ROI of code refactoring and long term cost stability.

Refactoring focuses on improving internal structure without altering external functionality. It reduces defect density, improves maintainability, and shortens development cycles. Financially, refactoring lowers cost per feature over time. However, it requires upfront investment in engineering hours that do not immediately generate revenue.

The decision to refactor should therefore be modelled against projected maintenance cost. If annual maintenance effort exceeds a defined percentage of development capacity, structured remediation becomes financially justified. Comparing remediation cost with projected savings over a three to five year horizon clarifies the investment case.

In some cases, incremental refactoring is insufficient. Legacy systems built on outdated stacks, including older RPG implementations or tightly coupled monoliths, may resist structural improvement. Migration to modern platforms such as Java based architectures or cloud native frameworks becomes necessary. This is where legacy system modernization services in Pakistan and comparable structured approaches gain relevance.

Our overview of enterprise architecture patterns explains how modular layering and service boundaries reduce future debt accumulation. Migration projects that adopt such patterns often achieve long term cost stability. However, poorly planned migrations introduce new complexity rather than eliminating existing debt.

Database modernisation also plays a critical role. Legacy relational schemas that evolved without governance may hinder scalability and analytics capability. Choosing between relational and distributed database models requires financial as well as technical evaluation. The trade offs are examined in SQL vs NoSQL database strategies. Data architecture decisions directly affect performance cost and reporting efficiency.

Phased transformation often produces better outcomes than full replacement. Organisations can isolate high impact modules and modernise them first. This reduces disruption risk and spreads investment over manageable intervals. Structured case evidence, such as those presented in EmporionSoft case studies, demonstrates how phased execution preserves operational continuity while reducing accumulated debt.

Migration cost must also account for organisational change. Team retraining, updated DevOps pipelines, and revised security policies require coordination. These indirect costs should be included in ROI modelling. Ignoring them leads to unrealistic projections.

External advisory frameworks can support due diligence before committing to large scale transformation. Independent evaluation models similar to those described in custom software development advisory approaches help leadership assess whether rebuild, re platform, or refactor strategies align with business objectives.

The critical principle is proportionality. Not every system requires immediate overhaul. The objective is to balance remediation investment against projected revenue growth, risk exposure, and operating margin improvement.

Modernisation, when grounded in disciplined financial analysis, converts technical debt from a liability into an opportunity. Reduced maintenance overhead, improved deployment speed, and enhanced scalability strengthen competitive positioning. When executed strategically, migration and refactoring initiatives do not merely resolve past inefficiencies. They reshape future cost structure and increase enterprise value.

Building a Sustainable Engineering Finance Strategy for Long Term Value

Technical debt becomes problematic when it is invisible to financial planning. The objective is not to eliminate debt entirely, but to manage its technical debt financial impact within a structured governance framework. This requires alignment between engineering, finance, and executive leadership.

Sustainable organisations treat architecture decisions as capital allocation choices. Every shortcut carries a future cost. Every refactoring initiative carries a potential return. When these trade offs are documented and evaluated systematically, technical debt becomes measurable rather than reactive.

A sustainable engineering finance strategy begins with transparency. Leadership teams should maintain visibility over debt ratio, maintenance allocation, cloud expenditure trends, and change failure rates. Integrating these indicators into quarterly reviews ensures that engineering health is discussed alongside revenue and margin.

Debt governance also intersects with FinOps for cloud cost optimization. Infrastructure cost discipline must sit within broader financial planning. Regular cost audits, tagging standards, and performance profiling reduce the risk of hidden operational escalation. Aligning these practices with the structured principles outlined in cloud cost optimization strategies strengthens long term cost predictability.

Board level oversight is equally important. Investors and stakeholders increasingly evaluate technology maturity during strategic reviews. Structured technical due diligence frameworks, such as those described in technical due diligence for startups, highlight how architecture quality influences valuation. Proactive governance signals operational maturity.

Reducing technical debt ratio in Agile environments requires disciplined execution. Allocating fixed remediation capacity, implementing automated quality checks, and conducting periodic architecture assessments stabilise long term performance. These practices align with broader advisory and delivery capabilities provided through EmporionSoft services.

Organisations that formalise these processes move from reactive firefighting to predictive management. Engineering teams operate with clearer priorities. Finance teams gain improved forecasting accuracy. Product leaders maintain delivery confidence because structural risk is controlled.

AI governance and automation also contribute to sustainability. As organisations adopt intelligent tooling, frameworks such as those outlined in AI governance for SMEs ensure that automation reduces cost without introducing unmanaged complexity. Governance discipline prevents new forms of debt from replacing old ones.

Ultimately, long term value creation depends on balance. Rapid delivery supports market growth, but structural resilience protects margin. Technical debt is not inherently harmful when it is intentional, documented, and time bound. It becomes costly when it accumulates silently.

For founders, CTOs, and SME leaders, the practical step is to treat architecture review as part of financial strategy. Periodic technical health assessments, structured cost modelling, and forward looking roadmaps create clarity. Organisations seeking structured evaluation can begin with a focused consultation through EmporionSoft consultation services.

A sustainable engineering finance strategy does not eliminate complexity. It manages it deliberately. When technical decisions are aligned with financial objectives, growth remains scalable, predictable, and resilient over time.